Archive for October 2011

Women Branching Out: Christyna Lewis

Financial coach Christyna Lewis talks about money in such a calm and centered way that you’ll relax and start planning for your own Financial Fridays (instead of avoiding your bank balance). You’ll see what I mean in this Women Branching Out interview. (transcript below)

Financial coach Christyna Lewis talks about money in such a calm and centered way that you’ll relax and start planning for your own Financial Fridays (instead of avoiding your bank balance). You’ll see what I mean in this Women Branching Out interview. (transcript below)

My side of the video wasn’t cooperating, so you’ll hear me, but not see me.

Enjoy.

Financial Fridays

Join Christyna for Financial Friday, November 4th, 9 a.m. – 11 a.m. Central on Twitter. To participate search for the hashtag: #FinancialFriday and join in the conversation. Plan your own Financial Friday dates with your business finances every week. For added community support, connect with Christyna the first Friday of each month on Twitter.

Christyna Lewis of BEE Ventures is a financial coach. She specializes in strength assessment, financial skill building, and reframing challenges to reveal their empowering possibilities. You can learn more about her work at BEE Ventures and by following her on Twitter.

Do you have a date with your business finances?

What strategies do you have in place to stay calm and centered about your finances? Share below! If you like this post please like it, tweet it, etc.

Interview Transcribed

Christie: Hi everybody. I have with me today Christyna Lewis (who also, I think goes by Christy a lot of the time, too) with me from BEE Ventures. Christyna is a … I would call her a financial guru, because that’s what I think about when I think about her. She helps entrepreneurs get really grounded and be empowered and informed about their finances and she helps other small businesses do that, too.

You can find her on her website which is beeventures.org and I’ll have a link to her website below the video or the audio. You can also talk with her on Friday, November 4th on Twitter she’ll be tweeting out financial information and answering your questions at the hashtag #Financial Friday. I’ll have that information posted below, too. So, hello Christyna!

Christyna: Hi Christie!

Christie: Hi! I’m going to let Christyna talk a little bit about her businesses and who she really loves to serve and what she does and we’ll start there. So, go ahead Christyna.

Christyna: Thank you so much Christie. So my business is BEE Ventures and the best way I can describe it is financial coaching. The people that I love to serve are idealists, they are healers, they are artists, they are the creative people who have this huge heart and this huge vision and they just want to leap out there and make it happen. They are the true innovators in our world.

A piece that my people often get tripped up about is numbers or this idea that with finances you’ve got to set all of your passion and values aside and it’s simply not true. So, I help them to get the basic skills and also the confidence to look at their numbers and be able to make the money and numbers really serve their larger purpose.

Christie: I know that you work with a lot of local companies there in (Houston) Texas. Do you also work with online people as well?

Christyna: I serve small businesses where ever they are. So we can do Skype. I got my beginning here locally because I’m such a community builder.

I think creating a network of people who are supportive of you and really know you is a humongous resource for any small business or anyone with a mission in the world. So, I started here and I definitely work nationally and internationally.

Christie: We were going to talk a little bit about what Financial Friday is. It’s November 4th and it’s on Twitter. Can you talk a little bit about what people can expect if they come and search for that hash tag #FinancialFriday.

Christyna: Oh, sure. Well Financial Friday got its beginning as one of the cornerstones of what I teach my clients: to be present to what is actually going on with their finances. So, I have them set up a date.

I like Financial Friday because it’s an alliteration. I like being able to finish up the week, it kind of ties up the week with a bow.

So, just once a week go in and see what is actually going on with your cash flow, what your needs are, what’s happening. From that state of knowing where you are … instead of just knowing that it’s awful, which is what a lot of people assume … then you are able to have peace and let all the worry go and make decisions based on what’s actually going on. There’s a lot of power in that and it just clears space for you to be more creative.

So this Financial Friday where I’m throwing open the doors, is a space for us to go through that together as a community. A lot of times people, especially creative people or people who are just getting going in business when they go to do numbers they close the shades. It’s late at night and they don’t want anyone to see it and they are not sure of themselves. So, here’s a space where they can ask any questions they have and we can celebrate any progress that they are making. Just to know that you are not alone in this is a humongous opening for peace.

You know, our finances are one of the last taboos and I’m creating a safe space to really take charge and have supportive structures for my community. So that’s Financial Friday.

I encourage people to do it every week. But our big open celebration is the first Friday of the month.

Christie: OK, great. What would you say is a good first step for somebody who has been ignoring their business finances?

Christyna: That’s a great question. I get that a lot actually.

The first thing to do is to just … you know … declare an amnesty and say whatever it is is fine. From there just begin to gather. Do you know what is in your checking account? Make a list of what you have and what you owe.

You don’t have to do this all at once. Go for 10 minutes and then if you get overwhelmed you put it away. You go deal with your favorite client or do something fun. But then come back to it and do another 10 minutes. Maybe the next day, maybe in a couple of hours so that first thing is just to know what you have.

You know, right alongside that mix in what you have as your vision for the impact that you want to have in the world. Does that make sense?

Christie: Mmhm. So that you are looking forward.

Christyna: Yeah, ‘cause I mean it’s not fun for a lot of people to get in and look at their finances. Right? There’s a lot of fear, there’s a lot of worry. We make it mean all kinds of things about who we are as people. And it doesn’t mean that. But if we are going to go to this place that’s not comfortable. Like for me I want you to be very clear that you have a powerful reason that you are doing it. Does that make sense?

Christie: Yes, yeah.

Christyna: I have a client who I’m thinking of right now. She is a marketer and she does a lot of back end stuff for online people. When we first started working together she was like “Oh, I need more clients. I’ve got to figure out what to do.” and she was just in this worry and was like needing more.

Once we got to where we could look at her numbers, we realized that she had had this beautiful five-year plan for moving her business forward and we cut the time frame of what she needed in half. So, it’s been a year now since then and she is halfway through her five year plan.

Because she actually had a much stronger financial foundation than she was even aware of.

I find that happens a lot, that people take their successes away because they don’t look like what we think of as financial success. So I’m here to celebrate that.

Christie: Cool. You’ve already given us some really great tips. What are some things that you see especially women doing with their business or personal finances that they need to give themselves some space on or some time to work on those things?

Christyna: That’s a great question. I see that especially women tend to either discount their savvy or say that the money doesn’t matter. It’s one thing to say that I’m living for this vision and I’m here … Mom’s are a great thing.

Mom entrepreneurs they are in businesses often so that they can create the life for their children that they want, so that they have time for everything that’s there. I want people, especially women entrepreneurs, to take small steps and create structures so they can have the capacity to have all the pieces that matter to them. And to recognize how far they’ve come.

If you are a mom and an entrepreneur, you have already stepped outside of the rat race that so many people are still stuck in. You are reclaiming the value of your vision for the world and for your children and that really matters. Stand strong in who you are and then from that space look at what is next for you financially. You know… we are so quick to heap on the needs and the wants and the oh, I should have or I wish that we had. I would like us to be just as quick to celebrate the steps that have already gotten us here.

Christie: That’s great. That’s why I like talking to you.

Christyna: Yeah, peace of mind is the biggest reward I think that we can get from taking good care of our finances. When you know where you stand and you are not worried about it then you are able to make decisions. Like actually saying “right now this is handled” and I’m going to go play with my children or take a nap that I need. Or just give you space to be creative and really the spaciousness to do a client project the way you would like to do it because you are not worried about the money.

Oftentimes my clients incomes do go up. But that’s because they’ve created the space. The peace of mind and the space open up first and the money follows. Does that make sense?

Christie: yeah, that makes total sense.

Christyna: That’s really upside down of what a lot of … how people think that money works … you know. We think that I need to make the money first and then I’ll have the peace or then I’ll be able to do what I want. But really standing in the power of what you do have and what you are already capable of, from there is where we are able to create more abundance.

Christie: Cool, thank you. Do you have any other advice you’d like to give? Or any other little tips.

Christyna: I’ve talked a lot about the big picture views, so let’s end with one real practical simple step.

I always recommend that you have a separate savings account, if you’re an entrepreneur then have one in your business. So you’ve got your business account and then you have a savings account (or it could be structured as a second checking account depending on how your bank fees work). You have a separate account that is money that has a name, that’s not ready for you to spend it yet. I pay my taxes quarterly. So every month I take money out of my main business checking account and I put it aside so that I’ll have the money there for my taxes.

Christie: Right.

Christyna: It’s a great way to save up for going to a great conference, or you know, there’s always taxes, there’s usually insurance. Any of the long term things take it out of that account.

There’s such a temptation to see something that looks amazing and you go check your checking account balance and say “cool I’ve got the money” without stopping to really think about oh, half that money is set aside for the deposit for my new office or for taxes or something. Because in that moment we are so excited about the opportunity in front of us that’s what we see.

So if we have a separate space, we won’t be as tripped up by that.

Christie: Great. That’s a great tip. Thank you so much, Christyna and everybody I will have Christyna’s email…or not email… website and her Twitter handle and the information about Financial Friday and how to participate in that below the audio/video, whatever we decide to do. So thank you so much.

Christyna: Thank you Christie. It is such a pleasure to be able to talk with you again today and to hopefully meet a bunch of your community, too. That would be really, really great.

Pick My Brain

Drop by and pick my brain during Open Office Hours ~ Thursday, October 27

You & Me together for casual conversation about your online presence and branding.

How are you feeling today about your website? Do you love it completely? Or do you feel like something’s missing?

Are you wondering what visitors think when they visit your site for the first time?

I’m inviting you to chat with me about your online presence and brand. I’ll take a look at your site and tell you what I see that’s good and what could use some gentle loving care.

Thursday, October 27th

9 p.m. – 11 p.m. Eastern

8 p.m. – 10 p.m. Central

7 p.m. – 9 p.m. Mountain

6 p.m. – 8 p.m. Pacific

You’ll find me on Skype: jewelsbranch

Send me a chat message to let me know you want to talk and I’ll ring you up.

Would love to see YOU there.

Have a question about open office hours? Email me.

Women Branching Out: Andrea Lewicki

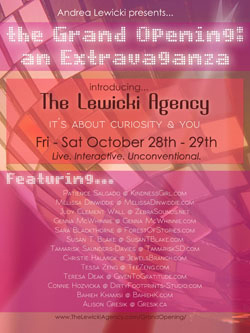

Are you curious? I’m so excited to interview Andrea Lewicki of The Lewicki Agency about using curiosity to engage with the world. The Lewicki Agency’s mission: “Defying convention, one curious project at a time.” Andrea is a great person to follow if you want to get back in touch with your sense of wonder.

Are you curious? I’m so excited to interview Andrea Lewicki of The Lewicki Agency about using curiosity to engage with the world. The Lewicki Agency’s mission: “Defying convention, one curious project at a time.” Andrea is a great person to follow if you want to get back in touch with your sense of wonder.

In this interview we chat about:

~ The Lewicki Agency’s Grand Opening Event (October 28-29, 2011) FREE! Come if you are interested in what curiosity can do for you.

~ The four cornerstones of curiosity: Listen. Ask. Observe. Give.

~ What triggers memories.

The Lewicki Agency Grand Opening: October 28-29, 2011

The Lewicki Agency Grand Opening is a free 2-day live, streaming, interactive introduction to Andrea’s curiosity work. October 28-29, 2011. Visit The Lewicki Agency for full details and a schedule.

The Lewicki Agency Grand Opening is a free 2-day live, streaming, interactive introduction to Andrea’s curiosity work. October 28-29, 2011. Visit The Lewicki Agency for full details and a schedule.

Guests include: Patience Salgado, Tamarisk Saunders-Davies, Susan T. Blake, Melissa Dinwiddie, Judy Clement Wall, Tessa Zeng, Sara Blackthorne, Genna McWhinnie, Bahieh Khamsi, and Christie Halmick (me).

Andrea Lewicki designs experiences for people to re-engage and maintain their curiosity. She believes that true curiosity is an ego-less quality that seeds kindness and compassion, and that the world is a better place when we can be who we really are. You can find out more about her work at www.thelewickiagency.com.

Because we are curious about you, please leave a comment below. Tell us about a memory you had recently, what triggered that memory?

I’ll go first, see my memory below.